For those who often visit Japan, you know to pay the consumption tax when purchasing something in Japan. Still, you wonder why shops do not state prices with tax included for easier understanding. In fact, that is a preparation for any possible tax increase. Today (1st October), the consumption tax in Japan goes from 8% to 10%. Inbound travellers may think that would just increase the travelling budget but thanks to “tax free” system, that influence should be, at all events, limited, but what other items and services cannot be tax-free will be affected by the tax increase? Let’s have a closer look together!

The Path of "Consumption Tax" Increase

A consumption tax is a tax levied on consumption spending on goods and services. (Exemption on some educational and medical spending). Below is a simplified history of the development of consumption tax in Japan.

- March 1989 - Introduction of 3% consumption tax

- April 1997 – Increase from 3% to 5%

- April 2014 - Increase from 5% to 8%

- October 2015 – Deferral of the original plan of Increase from 8% to 10%

- October 2019 – Implementation of increase to 10%

“Tax Reduction (軽減税率) ”- Consumption Tax for Some Items Remain as 8%

As a strategy to keep consumers' motivation to spend even with increase, Japan’s government stipulated a “tax reduction” for some items so their tax remain as 8%.

“Tax reduction” is applicable to,

- Foods and beverages

- Newspaper subscription (printed reports about general social affairs with at least 2 issues a week)

- Dining

Yet, be mindful that purchasing foods and drinks at convenience store and consume them in the in-store “eat in corner” is not applicable to “Tax Reduction”.

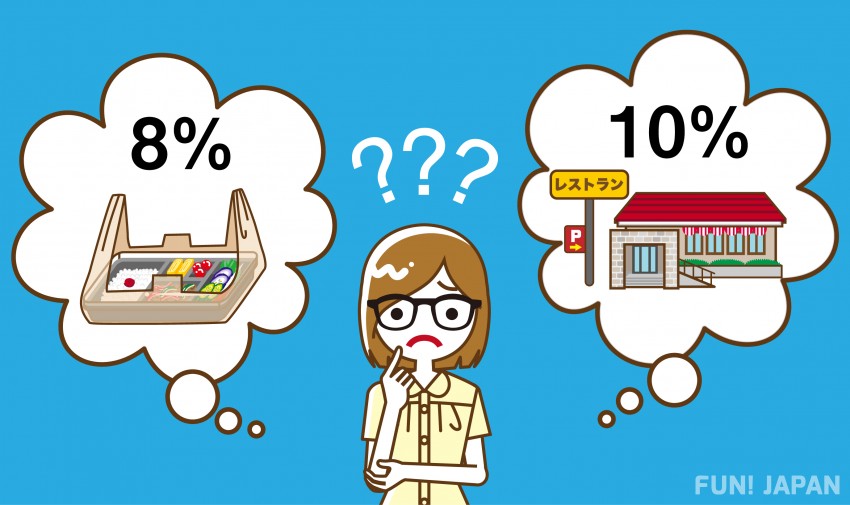

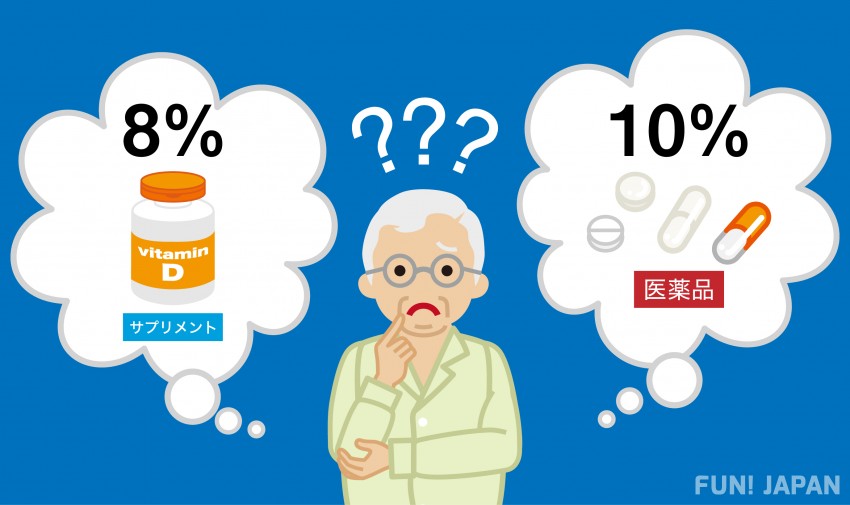

Should I pay 8% of Consumption Tax? Or 10%?

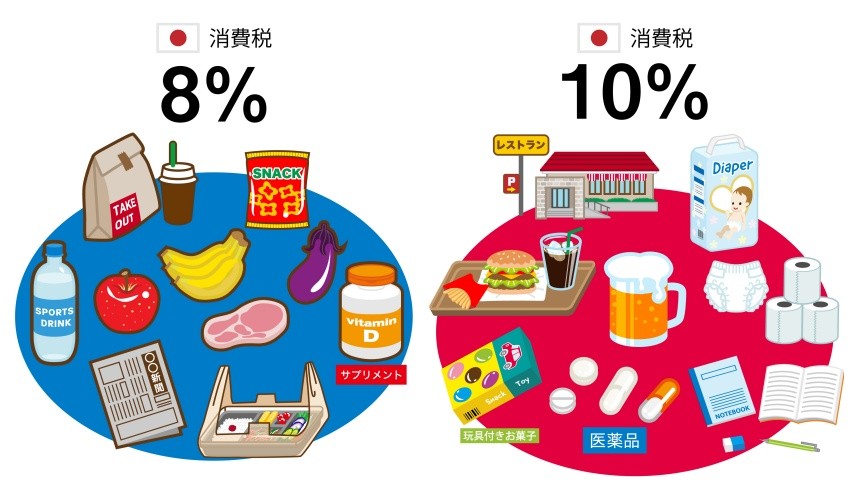

The consumption tax of the following items remains as 8%,

- Take away in restaurants and food shops.

- Convenience store

- Pharmacy

- Department store

- Supplements and health foods

*Only when purchasing the above items alone. Not applicable to alcohols.

The consumption tax of the following items goes up to 10%

- Dine in restaurants and food shops.

- Consumption of foods and drinks at convenience stores

- Alcohol, medical products, and medicines

Bonus Information- Tax-Free for Overseas Travellers

Tax exemption for overseas travellers was introduced in October 2014 and later revised in May 2016 for a more convenient shopping experience of travellers. Foreigners who entered Japan with a short-stay travel visa can enjoy “tax free” shopping in at shops with a “tax-free” logo.

“Tax-free” is applicable to the following items

- General items

- Consumable items

- Combined purchase of “general items” and “consumable items” exceed 5,000 yen at the same department store or shop on the same day.

*Consumers can choose whether to combine their purchase of general and consumable items.

*Consumable items will be sealed in a specific consumable goods plastic bag and should remain sealed throughout the stay in Japan (stickers on items inside so they would be easily recognizable if taken out)

2 Types of Tax-Free Payment

- At the special tax-free cashier, amount is calculated without the tax. For instance, at large pharmacies and daily life product shops.

- At general cashier, amount is calculated with the tax. And the customers go to their tax-free counter to have tax refund. For example, in department store and LOFT (a variety shop). Most of them charge an administration fee.

Comments